jersey city property tax abatement

Is this really what the city has in mind for tax abatements. Apply for the marriage license in the New Jersey municipality where either party resides.

A New Study Revives The Debate Over Property Tax Abatements

The city of Cleveland temporarily eliminates 100 of the increase in real estate tax of a property when the homeowners remodel or convert it into a two-family or multifamily home.

. Property Tax Abatement in Ohio. Click below to learn more about our tax abatement offerings. Simply put you get a tax break for the duration of the abatement says Golkin.

Tax Abatement Let us show you what the Industrial Development Agencies of Long Island can offer you. If neither applicant is a New Jersey resident submit the application in the municipality where the marriage ceremony will be performed. New Jersey authorized its municipalities to provide homeowners and property developers a 5-year tax abatement through the NJSA.

In New Jersey this apportionment is weighted at 502525. Mayor Brian P. I am writing to request an abatement of enter specific penalty in the amount of enter amount as assessed in the enclosed notice that is dated month.

Get a property tax abatement. When searching choose only one of the listed criteria. According to the citys website the City Council unanimously adopted a new tax abatement program to stimulate community revitalization improve existing housing stock and retain and attract residents to the City of Des MoinesThe Des Moines Register reported on the policy change saying it would.

For example if an owner has a 20-year tax abatement they will pay pennies on the dollar for the first 12 years of the abatement. The City of Canfield imposes a local tax of 10 on all income earned within the city. Ad Find Out the Market Value of Any Property and Past Sale Prices.

The homestead exemption is a Maine State program that provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence. The tax is levied on both the net income and the business earned in the City of Canfield and on the wages salaries and other forms of compensation earned by employees of the company in the City of Canfield. Pay lower taxes.

Taxes for multi-state corporations are apportioned using a three-factor formula of sales property and payroll. Request for Penalty Abatement taxpayer names address SSN or TIN Date To Whom it May Concern. Property owners would receive an exemption of up to 25000 on the tax assessed value.

The New Jersey County Tax Boards Association established that all real property be assessed at 100 of market its value. You may be able to ask for a Tax Abatement or Tax Holiday if you have low income or financial difficulties. Use code enforcement numbers to request a payoff.

New Jersey allows corporations to carry forward losses from prior years. Resolve bills or liens for work done by the City on a property. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Madison County Property Tax Inquiry. Resolve water liens. After that the tax will jump by 20 of the whole amount every two years.

Resolve judgements liens and debts. Basically this is an annual tax imposed by your municipal authorities based on the value of your property. Do not enter information in all the fields.

Stack and the Union City Board of Commissioners welcome you to the City of Union City. Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate. Garden City 50000 SF Industrial Land.

Pay Property Taxes Abatement Online. A Property tax is also known as Real Estate Tax or House Tax. In this case the license is only valid in the issuing municipality.

To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address. Have our agents analyze your property for maximum market potential. Pay outstanding tax balances.

Indicate what tax form it is pertaining to eg. Contact Us City of Union City NJ 3715 Palisade Avenue Union City NJ 07087 Tel. 1040 1065 etc and the tax period Re.

A second Trump Plaza tower had initially been planned but was delayed and the property for the proposed building was sold several times during the Great. Factors such as your propertys size construction type age. Fill out the information below to get started.

New Jersey has research and development credits capped at 50 of tax liability. The company is asking for a 10-year 100 percent abatement on its property taxes. The County Assessor determines each propertys the full and fair value as if it were to sell in fair and bona fide sale by private contract on the October 1 preceding the date the assessor completes the assessment list.

It is located adjacent to the Trump Plaza apartment tower which was completed in 2008. Trump Bay Street is a 50-story apartment tower named after Donald Trump and located at 65 Bay Street in Jersey City New Jersey. Resolve business and incomeWage Tax liens and judgments.

Appeal a property assessment. City Manager Tim Kelty told council members during a public hearing on the request that the Freeport Economic. The license is valid throughout New Jersey.

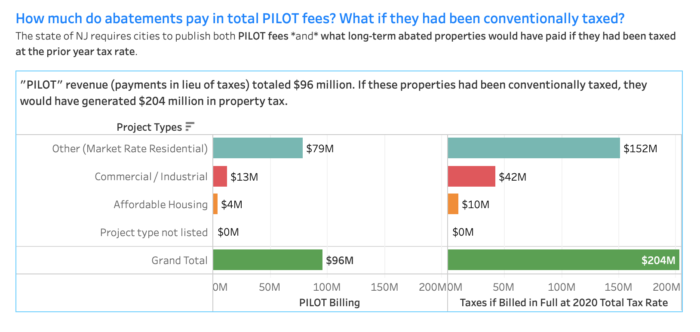

Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent

Luxury Ads에 있는 Wdd님의 핀 포스터 부동산

Updated Jersey City Abatements From 2016 User Friendly Budget Mapped By Project Type Ward Civic Parent

Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent

Updated Jersey City Abatements From 2016 User Friendly Budget Mapped By Project Type Ward Civic Parent

Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent

Jersey City Approximately 40 Million Of School Tax Is Locked Up In Abatement Contracts Civic Parent

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

Jersey City Rising Civic Parent

Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent

Cogneesol S 5 Step Tax Preparation Process Tax Preparation Tax Preparation Services Tax Consulting

A Closer Look At Jersey City S School Tax Rate Part 3 A Case For Increasing The School Tax Levy Civic Parent

Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent

What Is The 421g Tax Abatement In Nyc Hauseit

Why Taxes Are Rising In Jersey City Civic Parent

Jersey City 2021 Budget A Focus On Revenues Including How The City Is Achieving A Property Tax Cut Civic Parent

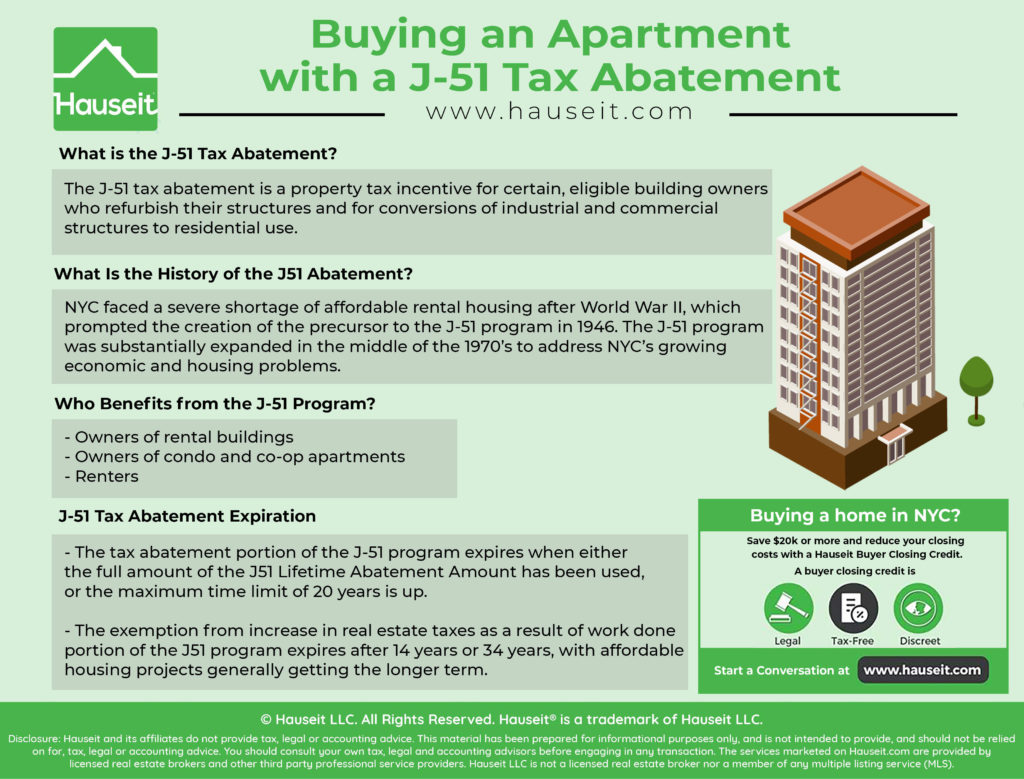

Buying An Apartment With A J 51 Tax Abatement Hauseit

Tax Abatement Series Civic Parent

One Theater Square Tower Rises Rapidly On Newark Skyline Newark Skyline Tower